As the global enterprise software market continues its journey of rapid evolution and maturation, a significant and accelerating trend towards market share consolidation is becoming one of its most defining characteristics. While the industry is renowned for its vibrant startup ecosystem and the constant emergence of new, innovative companies, the underlying economic and technological forces are increasingly favoring larger, more established platform players. In its earlier phases, many segments of the enterprise software market were highly fragmented, with numerous best-of-breed point solutions competing for customer attention. However, a clear pattern of centralization is now evident, where a smaller number of technology behemoths are capturing an ever-larger share of total industry revenue and profits. This shift is driven by a combination of evolving customer preferences for integrated suites, powerful technological network effects, and the immense capital requirements of competing on a global scale. A deep dive into the dynamics of Enterprise Software Market Share Consolidation is essential to understanding the market's long-term trajectory.

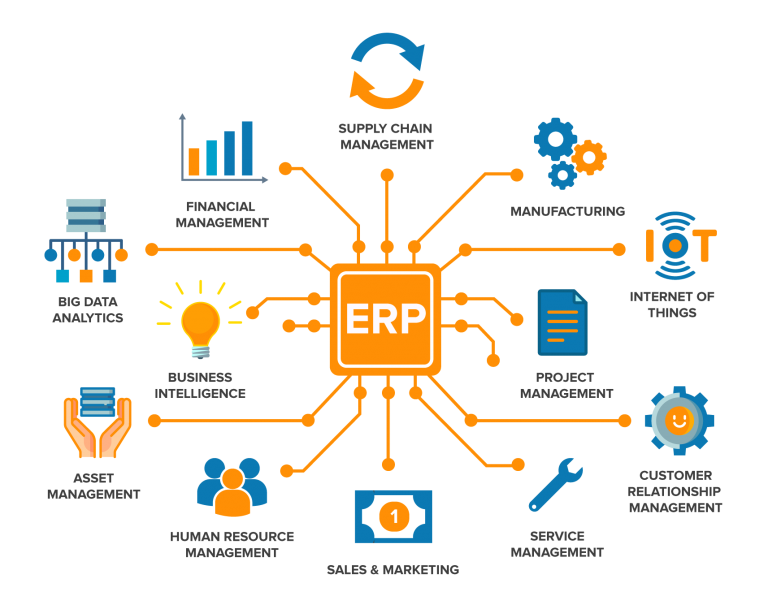

Several powerful and interconnected forces are driving this trend towards consolidation. A primary factor is the changing procurement behavior of large enterprise customers. Faced with the daunting complexity and integration challenges of managing hundreds of different software vendors, many enterprises are actively seeking to simplify their technology landscape and partner with a smaller number of strategic vendors who can offer a broad, pre-integrated suite of solutions. This "flight to platform" inherently benefits large players like Microsoft, Oracle, and SAP, who can provide a comprehensive portfolio covering everything from finance to customer service. Another critical driver is the power of data gravity and platform network effects. The Enterprise Software Market size is projected to grow USD 1,000 Billion by 2035, exhibiting a CAGR of 5.57% during the forecast period 2025 - 2035. Platforms with a larger user base can collect more data, which can then be used to train more effective AI models and deliver superior insights, creating a self-reinforcing cycle that attracts more users and further solidifies their market position. Additionally, the massive cost of global sales, marketing, and R&D creates a significant barrier to entry, favoring well-capitalized incumbents over smaller challengers.

The long-term implications of this consolidation trend are profound for the entire industry. The market is likely to evolve into a structure characterized by an oligopoly of a few major platform providers at its core, surrounded by a vibrant ecosystem of smaller, more specialized companies that either integrate with these major platforms or focus on highly specific niches that are not directly addressed by the larger players. This dynamic creates a very active M&A environment, as the consolidating players frequently acquire these smaller, innovative firms to fill gaps in their portfolios, acquire new technologies, or enter adjacent markets. For customers, this trend can lead to more powerful and seamlessly integrated solutions and simplified vendor management. However, it also carries the significant risks of reduced competition, potential vendor lock-in, and potentially less aggressive pricing over time as the competitive field narrows. Understanding this consolidation trend is therefore critical for both vendors, who must define their strategy in this changing landscape, and for customers, who must make long-term partnership decisions with a clear view of the market's likely future state.

Top Trending Reports -

Threat Intelligence Security Service Market