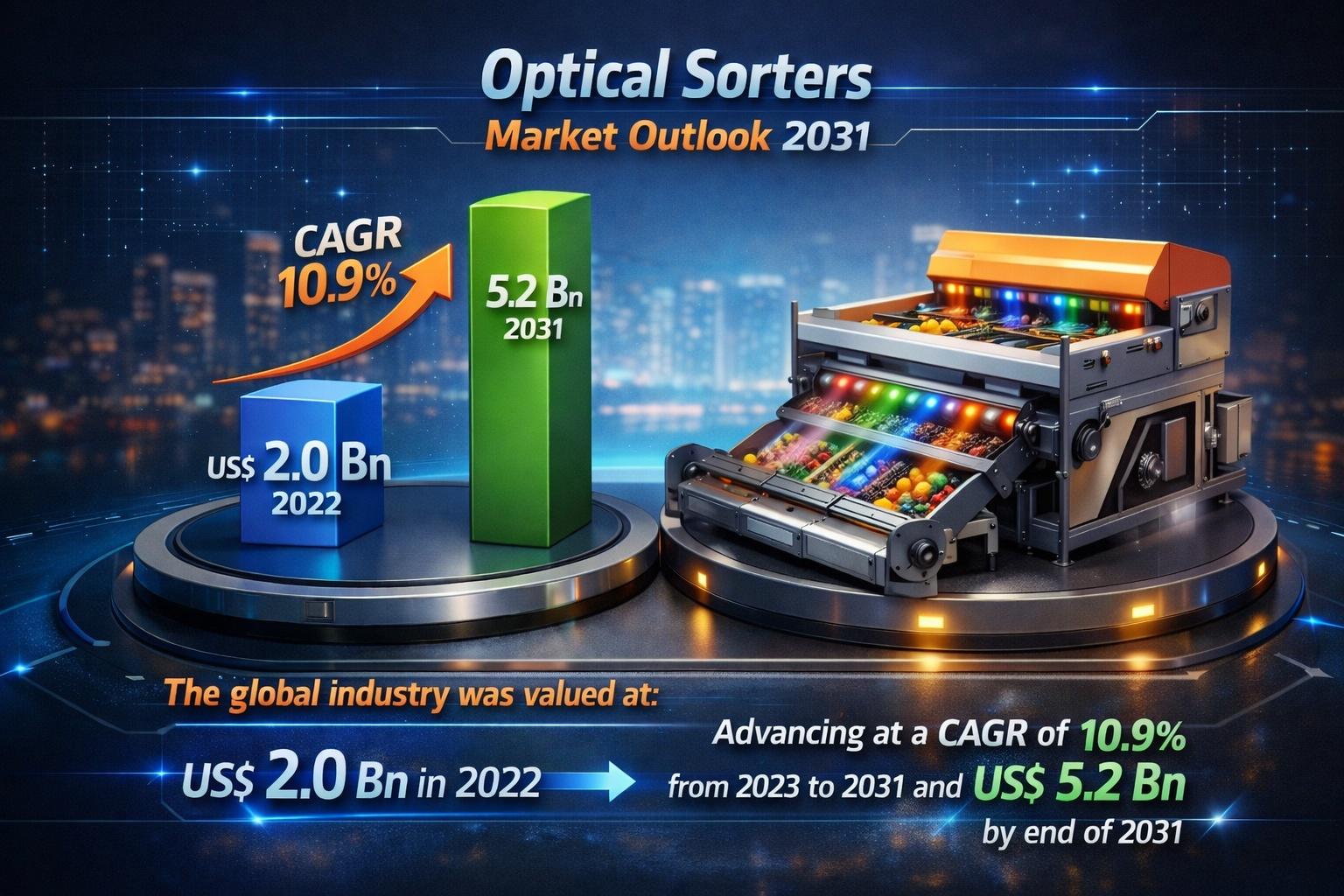

The global optical sorters market is witnessing strong momentum as industries increasingly adopt automation to improve quality, efficiency, and compliance. Valued at US$ 2.0 billion in 2022, the market is expected to expand at a CAGR of 10.9% from 2023 to 2031, reaching US$ 5.2 billion by the end of 2031. This growth reflects the rising need for high-accuracy sorting solutions across food processing, waste recycling, mining, and other industrial applications.

What Are Optical Sorters and Why They Matter

Optical sorters are advanced machines designed to identify, classify, and remove defective products or foreign materials from production lines. They rely on technologies such as near-infrared (NIR) spectroscopy, cameras, lasers, X-rays, and fluorescent lighting, combined with image processing software. These systems detect differences in color, shape, size, texture, and chemical composition—capabilities that are difficult or impossible to replicate with manual inspection.

Modern optical sorting systems are typically built around belt sorters or slide sorters, enabling high-speed, automated sorting while maintaining consistent accuracy. With the integration of artificial intelligence and advanced algorithms, optical sorters are now able to process massive data streams in real time, making smarter decisions with minimal human intervention.

Processed and Packaged Food Driving Demand

One of the primary drivers of market growth is the surge in demand for processed and packaged food. Optical sorters are widely used in food processing to detect discoloration, foreign materials, and defects, ensuring product quality and food safety. For example, optical vegetable sorters provide 360-degree scanning, rotating products under high-speed cameras to achieve complete surface inspection.

As global food supply chains expand and consumer expectations around quality rise, food processors are increasingly investing in optical sorting technology. In fast-growing markets such as India, where the food processing sector has been expanding rapidly, optical sorters play a critical role in meeting both domestic and export quality standards.

Labor Shortages and Automation Accelerate Adoption

Rising labor costs and labor shortages are further accelerating the adoption of optical sorters. Automated sorting systems reduce dependency on manual labor while delivering higher throughput, greater accuracy, and consistent quality. They also contribute to cost savings by lowering energy consumption, reducing waste, and minimizing rework and recalls.

At the same time, governments are implementing stringent food safety and quality regulations, particularly in developed markets. Automated inspection using optical sorters helps manufacturers comply with these regulations while protecting brand reputation and consumer trust.

For More Details, Get Sample PDF: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=45429

Regional Insights: North America Leads

North America held the largest market share in 2022, driven by strict food safety regulations and strong adoption of optical sorters in food processing and waste recycling. In the U.S., frameworks such as the FDA Food Safety Modernization Act (FSMA) emphasize preventive controls and contamination reduction, boosting demand for advanced sorting solutions.

Competitive Landscape and Innovation

Leading players such as TOMRA Systems, Bühler Holding, Key Technology, Satake, Cimbria, and Binder+Co are investing heavily in innovation. Emerging trends include hyperspectral imaging, AI-driven sorting, multi-sensor fusion, 3D imaging, and cloud-based analytics, all aimed at improving accuracy, speed, and sustainability.

Looking Ahead

As automation becomes central to industrial operations, optical sorters are evolving from quality-control tools into strategic assets. By 2031, their role in improving efficiency, reducing waste, and ensuring compliance will make them indispensable across multiple industries worldwide.